Among the numerous Amex credit cards that have undergone enhancements in recent months, The Platinum Card® from American Express continues to stand out as one of the best cards. With benefits valued at over $1,400, the Amex Platinum card also boasts an attractive welcome bonus offer. But is the Amex Platinum hard to get? We’ll break down the approval factors below.

Oh, and let’s talk about THAT welcome bonus with The Platinum Card® from American Express! You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Even if you aren’t eligible for a targeted offer, there is a great public welcome bonus to consider.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

How Hard Is It To Get The American Express Platinum Card?

Use this guide to jump to specific approval factors and benefits:

- Credit Score Needed for American Express Platinum

- How hard is it to get the Amex Platinum

- Do You Need to Be 21 for the American Express Platinum?

- Required Salary

- Annual Fee

- Little-Known Benefits of the Platinum Card

- Summary

With its generous welcome bonus, tiered purchase rewards, annual travel credits, and fringe benefits that will make any frequent flier drool (as exemplified in our comprehensive American Express Platinum review), the Amex Platinum metal credit card is highly sought after.

While many travelers are interested, how difficult is it to get the Platinum Card® from American Express? Let’s find out what the Amex Platinum requirements are.

Related: Are Credit Cards Worth Their Annual Fees? Things To Consider

Is Amex Platinum Hard To Get?

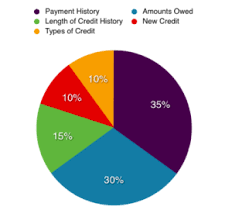

The credit score needed for the American Express Platinum is generally above 700. According to Credit Karma, the average score is 715, so it’s not incredibly hard to get the Amex Platinum card. However, several applicants with credit scores in the 600s have also been approved, even as low as 643.

If your credit score is borderline 700, you might wait until your score crosses that threshold. That way, you can be considered to have good or above-average credit. A few ways to quickly boost your credit score include paying any current credit card debt, paying off a financial loan, and not trying for any new credit accounts. This includes not trying for any additional credit card accounts, as each inquiry will drop your score a few points.

Up to 175,000 Points Offer: The Platinum Card® from American Express

If your credit score is in the 600s, you can still get approved for The Platinum Card® from American Express, but it depends on your credit quality. Your approval chances will be highest if you have a low debt-to-income ratio and have not applied for many new credit accounts recently. This tells American Express that while you might have a low score, you can responsibly manage your credit.

Too Many Accounts

Having too many new accounts can jeopardize your approval chances because the reviewer might think you are going on a spending spree and will not afford the monthly payment. While American Express doesn’t have the rigorous 5/24 rule like Chase, where your application is declined if you have five new credit cards within the last 24 months, too many recent applications can still raise a red flag.

You can only receive a welcome bonus on American Express cards once per lifetime. This is very important to note regarding the American Express Platinum requirements.

Consider Getting Another Amex Credit Card First

If you are concerned about your credit score, you might consider getting another American Express card first. If you don’t already own a credit card, this can be a wise move. Your approval odds increase if you can responsibly manage a credit card.

Having another American Express card lets you establish a relationship with Amex. It can also make it easier to add the Amex Platinum Card to your wallet in the near future. American Express offers several of the best no-annual-fee travel credit cards.

Other Options

You might consider the American Express® Gold Card as it also offers travel and dining benefits and is cheaper than the Platinum Card (the annual fee for the Gold Card is $325; See Rates & Fees). But, it doesn’t come with all the additional travel benefits nor earn purchase rewards as quickly on travel purchases.

You may also want to check out some of the other best credit cards for travel miles options that come with lower annual fees.

Some experts recommend waiting two years after getting your first credit card to try for the Amex Platinum. This decision largely depends on your credit history. If you have a credit score in the 700s or upper 600s, you might be able to try for one in as little as six months, provided you have never missed a payment.

Since the Platinum Card is one of American Express’s top-of-the-line cards, building a relationship with Amex can make it easier for approval down the road. The Amex Platinum is one of the most prestigious travel credit cards you can own.

Do You Need to Be 21 for the American Express Platinum Card?

Your approval chances are much better if you’re 21 years old or older when you try for The Platinum Card® from American Express. To be an authorized user, you must be 18 years old. As most teenagers do not have the credit score or income to pay the annual fee, this restriction won’t disqualify too many applicants.

Basically, American Express wants to know if their applicants have shown they can honor their commitments by being steadily employed or graduating college in the four years between when they graduate high school at age 18 and usually get their first “real” job at age 21.

You can still submit an application if you are under 21. However, you might have to submit additional documentation to verify your income.

Is Amex Platinum’s $695 Annual Fee Worth It?

The Amex Platinum has a high annual fee of $695 (See Rates & Fees).

Unlike other credit cards that waive the annual fee for the first year, the $695 annual fee will be charged on your first monthly billing cycle. If you don’t have $695 to pay the annual fee, don’t try for the card.

If you want to add an authorized user, you will also need to pay $195 upfront for each additional card.

The benefits below are proof that some travel credit cards are worth it:

Benefits

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® points on prepaid hotels booked with American Express Travel.

Cardholders can get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel® when they pay with the Platinum Card®. The Hotel Collection requires a minimum two-night stay.

Also, select one qualifying airline and receive up to $200 in statement credits per calendar year for incidental fees charged by the airline to your Card.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now, there are even more places where your Platinum Card® from American Express can get you complimentary entry and exclusive perks.

Additional The Platinum Card from American Express perks

There’s also a digital entertainment credit, making this card one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Enrollment required.

Cardholders can enjoy TSA PreCheck or Global Entry access and CLEAR perks. When paying with their card, they can get up to $199 back per calendar year on their CLEAR Membership (subject to autorenewal). Plus, receive either a $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

Plus, get a $155 Walmart+ credit, which covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. The cost includes $12.95 plus applicable local sales tax.

Get the full details and learn more in our in-depth The Platinum Card from American Express review.

Salary Needed for Amex Platinum Credit Card

There are no published salary requirements in order to qualify for The Platinum Card® from American Express. But the more you earn, the better. If you make nearly $100,000 a year and have good credit, you should have no issue getting approved. However, applicants with annual incomes as low as $40,000 have also been approved if they have a low debt-to-income ratio and pay their other credit cards in full every month.

Having a lower income means you will most likely get a lower credit limit. But it still means you get the Platinum Card and can enjoy all the benefits. You just might have to make other purchases on your secondary cards to keep your monthly balance below 30% of your Platinum Card’s credit limit.

This will help maximize your credit score.

Related: Best Places To Get A Free Credit Score

Going for the Amex Platinum Card

The last step is to try for The Platinum Card® from American Express. The easiest way is online as you enter all your personal information and your salary to receive an instant decision. If American Express has a few questions about your credit history, they might hold your application for additional review and give you a decision within a few business days.

You will also need the full name and social security number of all people you wish to add as an additional cardholder.

HOT: Targeted 100K+ Amex Platinum offer.

How Hard Is It to Get the American Express Platinum?

Getting approved for the American Express Platinum is like any new credit card application. You have better chances with a credit score above 700, a clean credit history, and a low debt-to-income ratio. If you think you might have to work on these factors, take the time to improve your credit to enjoy the benefits.

Up to 175,000 Offer: The Platinum Card® from American Express

Little Known Benefits of the American Express Platinum Card

The Platinum Card® from American Express is one of my favorite premium credit cards. There are many well-known benefits, such as the ability to earn 5X Membership Rewards® points per dollar spent on purchases made directly with airlines or at American Express Travel®, up to $500,000 on these purchases per calendar year.

There are also some great hotel perks, helping it land some of the best hotel card offers list. Terms apply, and enrollment may be required.

But there are a ton of other great benefits jam-packed into this card that you might not know about.

10 Little-Known Benefits of the Amex Platinum Card

Here are ten little-known American Express benefits of The Platinum Card. Note that enrollment may be required for the benefits below. Terms may apply.

Related: The Best Premium Credit Cards To Use For Rewards

1. Emerald Club Executive Membership with National

This is one of the benefits of the Platinum card that you’ll love if you do a lot of driving. You can enroll in the National’s Emerald Club program and automatically be upgraded to their Executive status level. When you’re Executive, you can select from a special aisle of cars at participating locations, usually including many great rental options!

This benefit of the Platinum card has made National my favorite car rental company. Recently, I’ve been able to upgrade to a VW Bug convertible, a Jeep Wrangler, and a Cadillac XTS, even though I paid for the cheapest economy car possible!

The Amex Platinum is also one of the best credit cards for car rental insurance.

2. American Express Concierge

If you want to be known as the person who scores seats for sold-out events, you’ll love the benefits of the Platinum card. Do you need help with a tough-to-nail restaurant reservation or event tickets? Do you need assistance with your Christmas shopping?

The American Express Concierge can help. Simply call (800-525-3355) or email with your request, and they’ll do what they can to meet your needs.

3. Presale Tickets Access

Similar to the above, this is one of the benefits of the Platinum card that will help you score those impossible seats. Cardholders have access to presale tickets to concerts and events from Ticketmaster. This is a great benefit if there’s a show you’ve had your eye on.

American Express also regularly offers early or exclusive access to other events, such as the theater production of Hamilton.

4. Reserved Seating

Another concert benefit – get preferred seating when you reserve your tickets with Ticketmaster using the offer code on the back of your card. This is one of my favorite benefits of the Platinum card. You can sit in front and center and enjoy the show.

5. By Invitation Only Events

If small, intimate events are your thing, this benefit is going to come in handy. American Express books events for cardholders with celebrity chefs and other celebrities. They tend to be expensive but are small, intimate, and incredibly unique.

More conventional but still highly desirable events, like the ball dropping in Times Square for New Year, are also available.

Up to 175,000 Points Bonus Offer: The Platinum Card® from American Express

6. Cruise Privileges

When you book a cruise through Amex Cruises, you’ll get up to $100- $300 in onboard credit for each stateroom. You’ll also be eligible for additional amenities that vary by cruise line. This is definitely one of the better benefits of the Platinum card if you like to travel by air, land, and sea.

There’s a reason why the Platinum Card from American Express is one of the best rewards credit cards!

7. Global Dining Collection

Certain restaurants reserve a table specifically for American Express card members. You may book these tables through the Amex Platinum Concierge.

Additionally, cardholders have access to special events and experiences at some restaurants, such as kitchen tours.

8. InCircle Loyalty Program

After enrolling in InCircle, you’ll get up to a $100 InCircle Point Card for every $10,000 you spend at Neiman Marcus, Bergdorf Goodman, Last Call, Horchow, and Cusp. Points are not earned on sales tax, shipping, alterations, gift packaging, and several other things. This is one of those great little additional benefits of the Platinum card if you shop at these stores anyway.

9. Premium Private Jet Program

If there’s ever a time you need to hire a private jet, you can book it directly through American Express Travel. While not a benefit that most people will need regularly, it’s a nice option to have in your back pocket.

10. Global Boingo Wi-Fi Membership

This is probably one of the most useful and widely used benefits of the Platinum card. While it’s usually not too difficult to find free WiFi, your American Express Platinum card gives you access to a Boingo WiFi membership. Boingo has over one million hotspots available worldwide.

This could be the difference between WiFi and no WiFi or lightning-fast speeds and slower connections. However, you must register to access these hotspots.

Summary of How Hard Is It To Get Amex Platinum Card

As you can see, the Platinum Card® from American Express has a ton of benefits. You likely don’t know about these benefits because they don’t get as much attention.

Personally, I really love that I have access to the Executive Aisle cars when I rent from National. I also occasionally use the Boingo membership that comes with my card. Which of these benefits of the Platinum card from American Express is your favorite?

HOT: Targeted 100K+ Amex Platinum offer.

Related Posts:

- Chase Sapphire Preferred vs. Amex Platinum Review

- American Express Platinum Review

- Amex Business Platinum Card Review

- How Hard is it to get the Amex Business Platinum Card?

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card® from American Express, please click here.

For rates and fees of The American Express® Gold Card, please click here.

Wow, this list of hidden Amex Platinum benefits is amazing! I never knew about the National car rental upgrades or the InCircle points at Neiman Marcus. These definitely make the high annual fee a little easier to swallow. Thanks for sharing!

Excellent article on the American Express Platinum Card! It’s clear, informative, and really demystifies the process of applying for this prestigious card. The detailed breakdown of requirements and benefits is super helpful for anyone considering this card.

About that additional card member: It seems from the available information that the only benefit to being an additional Platinum rather than Gold Card member is that the holder has access to the lounges on par with the primary account holder. Is that the case?

The additional card members for Amex Platinum are NOT $175 each. Upto three are included in the $175 anf 4th and on are additional $175 each.

Also, the boingo benefit for discontinued WAY before this article was published.

Do your research carefully before spreading misinformation.

Thank you