This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Finding the best United credit cards in 2024 has gotten easier, thanks to a variety of options that fit different needs. With several cards to choose from and a variety of perks that come with each, you’re bound to find one that works for your lifestyle.

Plus, United Airlines is one of the major airlines in the United States, so there’s a good chance you’ll be flying with them at some point. To maximize these United Airlines flights, especially if you plan on flying United often (even if that is further down the road), consider one of the Chase-issued United Airlines credit cards.

Currently, there are new higher bonus offers on the Chase United cards:

- New United℠ Explorer Card cardholders can earn 60,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

- New United Quest℠ Card cardholders can earn 70,000 bonus miles and 500 Premier qualifying points after spending $4,000 on purchases in the first three months their account is open.

- New United Club℠ Infinite Card cardholders can earn 90,000 bonus miles after spending $5,000 on purchases in the first 3 months from account opening.

Best United Credit Cards 2024

Here’s a preview of the best United Airlines credit cards:

- For a mid-level premium card with plenty of perks: the United Quest℠ Card

- Most Flexible (2x points and points transfer to United): Chase Sapphire Preferred® Card

- For Those Who Check Baggage, the Best United credit card is: the United℠ Explorer Card

- Premium Traveler’s Best United credit card: United Club℠ Infinite Card

- Business Travelers: United℠ Business Card

- For the occasional United flyer: United Gateway℠ Card

Best United Credit Card With Plenty of Perks: United Quest Card

The United Quest℠ Card can add plenty of value to your travel thanks to the numerous perks available including free first and second-checked bags, savings of up to $360 per roundtrip (terms apply), plus priority boarding.

United Quest cardholders can earn 3x miles on United® purchases, 2x miles on dining, select streaming services, and all other travel, and 1x on all other purchases.

Cardholders get up to a $125 United® purchase credit and up to 10,000 miles in award flight credits each year – terms apply.

Additionally, earn up to 6,000 Premier qualifying points (25 PQP for every $500 you spend on purchases).

Plus, get a one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

New United Quest℠ Card cardholders can earn 70,000 bonus miles and 500 Premier qualifying points after spending $4,000 on purchases in the first three months their account is open.

There is no foreign transaction fee, but the annual fee is $250.

Related: United Quest Card Takes Off

Best Non-United Airlines Card for Earning United Miles: Chase Sapphire Preferred Card

How can a non-United Airlines credit card make the list for being the best United credit card? There is a touch of irony in this question, yet the answer is really simple. Own a flexible best travel credit card like the Chase Sapphire Preferred.

The Chase Sapphire Preferred review shows us that it has the exact same earning power as the United Explorer Card but earns rewards on every travel and dining purchase.

There are several Chase Sapphire reward categories. The Chase Sapphire Preferred earns unlimited:

- 5x points on travel purchased through Chase Ultimate Rewards® (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Also 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

There is a $50 annual Ultimate Rewards Hotel Credit. It comes in the form of a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Ultimate Rewards program, up to an annual maximum accumulation of $50.

Plus, on each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Chase Ultimate Rewards

United is a Chase Ultimate Rewards travel partner. By owning the Chase Sapphire Preferred or Sapphire Reserve, you can transfer your credit card points to United on a 1:1 basis, free of charge. If your primary focus is rapidly earning rewards miles that can be redeemed for any United flight, this is your best option.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel℠.

Unless you want the free checked bags, priority boarding, or two annual one-time United Club passes that come with the Explorer, the Sapphire Preferred can be the better option for these reasons:

- You can choose to fly on the cheapest carrier, United or otherwise, so long as they are a Chase partner

- You can redeem for other travel opportunities and have more flexibility

- The Chase 5/24 rule only lets you apply for one credit card

Since you can only carry so many credit cards in your wallet, you might consider the Sapphire Preferred over the other cards on this list because you earn for every air travel purchase, regardless of the carrier.

You won’t enjoy any of the complimentary United amenities like free checked bags or United Club membership. But, you can earn bonus rewards points much faster. You can then redeem them for United flights even when you earn them through non-United air travel.

Best Chase United Credit Card for Checking a Bag and Earning Miles: United Explorer Card

The United℠ Explorer Card is a good option if you travel more frequently. While this card has a $95 annual fee (waived the first year), you will want this card if you want to earn miles that can be redeemed for United award flights and also want to check a bag for free. As an Explorer cardholder, you will enjoy the following card amenities:

- First checked bag free for you and one travel companion ($160 savings per roundtrip) when using your card to purchase your ticket

- Two United Club passes (one-time entry) for each card anniversary

- Priority Boarding for everybody in your travel party as long as you are on the same reservation

The free checked bag benefit alone pays for the $95 annual fee ($0 for the first year) during your first round-trip when you and one travel companion each check one bag. You might decide to pick up this card only for these benefits. Additionally, you’ll get up to $100 statement credit to use towards Global Entry, TSA PreCheck, or a NEXUS application fee.

Cardholders can also enjoy 25% back as a statement credit on purchases of food, beverages, and Wi-Fi onboard United-operated flights and on Club premium drinks when they pay with their Explorer Card.

United Explorer Card Rewards

In addition to the above amenities, you will also earn 2x miles per $1 spent on United® purchases, dining (including eligible delivery services), and hotel stays. You’ll earn 1x mile per $1 spent for every non-United purchase. These miles will not expire as long you own a United credit card or keep your MileagePlus account active.

Plus, get a one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

New United℠ Explorer Card cardholders can earn 60,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

Plus, there’s a $0 introductory annual fee for the first year, then $95.

Reward flights start at 12,500 miles each way for United flights within the continental U.S. and Canada.

Best United Credit Card For Travelers Who Love Perks: United Club Infinite Card

If you LOVE premium travel rewards and are a loyal United flyer, look no further than the United Club℠ Infinite Card. This is the flagship card of the Chase United catalog. The United Club Infinite Card will let you enjoy everything United has to offer!

Let’s begin with the unlimited United amenities that you will enjoy:

- Complimentary United Club℠ membership ($650 value) for you and eligible travel companions

- Access to participating Star Alliance airport lounges

- United Premier Access (priority check-in, security screening (where available), baggage handling and boarding privileges)

- Up to $100 Global Entry, TSA PreCheck®, or NEXUS fee credit

Cardholders earn 4x miles per $1 spent on United® purchases, 2x miles per $1 spent on all other travel, 2x miles per $1 spent on dining, and 1x miles per $1 spent on all other purchases.

You also get free first and second-checked bags, savings of up to $360 per roundtrip (terms apply), plus Premier Access® travel services. Also, get a 10% United Economy Saver Award discount within the continental U.S. and Canada.

Cardholders can also get 25% back as a statement credit on purchases of food, beverages, and Wi-Fi onboard United-operated flights when paying with their Club Infinite Card.

United Club Infinite Card Benefits

In addition to the United amenities, you will also enjoy a few other travel perks, including Luxury Hotel and Resort credits, Hertz Gold Plus Rewards® President’s Circle® Elite Status, and primary auto rental collision damage waiver coverage.

Additionally, earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases).

New United Club℠ Infinite Card cardholders can earn 90,000 bonus miles after spending $5,000 on purchases in the first 3 months from account opening.

All of these benefits come with an annual fee of $525. This is in line with the other premium travel credit cards that offer similar travel benefits.

Best United Credit Card for Business Travelers: United Business Card

If you are a small business owner, check out the United℠ Business Card, which also has many of the benefits that the consumer United Explorer card has. Employee cards are free, and their spending can be capped if needed. Employee cards also earn miles on purchases.

Additionally, get a $100 United® travel credit after 7 United flight purchases of $100 or more each anniversary year.

With perks like a free first checked bag (a savings of up to $160 per roundtrip—terms apply), 2 United Club one-time passes per year, and priority boarding privileges, the United Business Card has plenty to offer.

New United℠ Business Card cardholders can earn 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening. Plus, enjoy a $0 introductory annual fee for the first year, then $99.

United Business Card Rewards

United℠ Business Card cardholders earn 2x miles per $1 spent on United® purchases, dining (including eligible delivery services), gas stations, office supply stores, and on local transit and commuting. Earn 1x mile per $1 spent on all other purchases.

Also, cardholders can receive a 5,000-mile “better together” bonus each anniversary when they have both the United℠ Business Card and a personal Chase United® credit card.

Additionally, get a one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

You won’t have to worry about foreign transaction fees.

This card also features Chase’s contactless payment technology.

Best United Credit Card for the Occasional United Flyer: United Gateway Card

The United Gateway℠ Card comes with some exciting ways to earn miles, all without an annual fee to worry about. Cardholders earn 2x miles per $1 spent on United® purchases, at gas stations, and on local transit and commuting including rideshare services, taxicabs, train tickets, tolls, and mass transit. All other purchases earn 1x mile per $1 spent.

Cardholders also get 25% back as a statement credit on purchases of food, beverages, and Wi-Fi onboard United-operated flights when they pay with their Gateway Card. You can bring this card with you when you travel abroad because there are no foreign transaction fees on this contactless card.

If you want to use your miles to book flights, note that there are no blackout dates for primary cardholders.

Plus, get a one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

New United Gateway℠ Card cardmembers can earn 30,000 bonus miles after spending $1,000 on purchases in the first 3 months the account is open. Plus, 0% intro APR for 12 months from account opening on purchases. Learn more.

The Best United Credit Cards 2024

Owning a United credit card is the easiest and most cost-effective way to earn award miles that can be redeemed for free award flights. There is a United credit card for every budget that will enhance your United travel experience. If you want to make every purchase count, none of these cards will steer you in the wrong direction.

60,000 Bonus Miles With the United Explorer Card

If you fly on United Airlines often, you’ll want to check out the Chase United℠ Explorer Card.

New United℠ Explorer Card cardholders can earn 60,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

Plus, there’s a $0 introductory annual fee for the first year, then $95.

Let’s take a deeper dive into what this Chase United credit card is offering.

Earn 2 Miles Per $1 On Hotels and Restaurants

You will begin earning unlimited 2 miles per $1 on the following purchases:

- United® purchases

- Hotel stays

- Dining, including eligible delivery services

All remaining bonus categories will earn 1 mile per $1 spent. With these bonus category editions, you now have more incentive to make the United℠ Explorer Card your primary travel rewards credit card.

However, if you’re not married to flying United, the Chase Sapphire Preferred already earns points per $1 on restaurants and Ultimate Rewards points are transferable. Plus, if you have to rent a car or book any other travel purchases, you can still earn points with the Chase Sapphire Preferred bonus and transfer your points on a 1:1 to your United MileagePlus account.

$100 Global Entry, TSA PreCheck, or NEXUS Fee Credit

A credit for Global Entry is probably the most popular benefit for travel rewards credit cards of every stripe. This benefit reimburses your application fee every four years and saves you $100. You won’t have to wait through the long lines to re-enter the United States for international travel and the TSA security lines for domestic flights.

If you don’t have a valid passport or don’t have time to visit a Global Entry enrollment center, this new benefit also reimburses the $85 application fee for TSA PreCheck. You’ll still have to go through the regular Customs security line when you travel abroad, but you can breeze through airport security for domestic travel.

Alternatively, you can use it towards the NEXUS application fee.

25% Back on United In-Flight Purchases

Cardholders can also enjoy 25% back as a statement credit on purchases of food, beverages, and Wi-Fi on board United-operated flights and on Club premium drinks when they pay with their Explorer Card.

Additional Chase United Explorer Card Benefits

In addition to the benefits listed above, you’ll also enjoy these benefits:

- Your first bag flies for free (up to $160 per roundtrip)

- Priority boarding

- No blackout dates

- Upgrades on award tickets

- Two United℠ Club one-time passes

- No foreign transaction fees

If you crave experiences as much as the United travel benefits, you will also continue enjoying access to Inside Access once-in-a-lifetime events, including celebrity meet and greets, redeeming MileagePlus miles for MileagePlus events, and on-site benefits with the Visa Signature Luxury Hotels and Resorts Collection when you book a stay with your United℠ Explorer Card.

Redeeming Your United MileagePlus Miles

Domestic United award flights start at 12,500 miles for most flights within the mainland U.S., Alaska, and Canada. However, you can book a flight that is 700 miles or less for 10,000 miles each way.

Make sure you log into your account before browsing award seat availability, otherwise you might end up paying for the more expensive Everyday Award seat instead of the discount Saver Award seat.

Transfer Ultimate Rewards Points as Necessary

United is a 1:1 transfer partner of Chase Ultimate Rewards. You can transfer points in 1,000-point increments to your United MileagePlus account for free when you need to book an award flight but don’t have quite enough miles at the moment.

Even if you just own the United℠ Explorer Card to book your United flights and enjoy the free Global Entry and checked baggage benefits, owning the Sapphire Preferred or Sapphire Reserve lets you earn bonus points on all travel and dining purchases. By using these cards, you’re always earning the most points and miles possible on every purchase!

With the United℠ Explorer Card, you can earn 2x miles per $1 spent on hotels and dining in addition to United® purchases. United also reimburses your Global Entry, TSA PreCheck, or NEXUS application fee and gives you 25% back on United® inflight purchases.

Check Out the United Business Card

United Airlines business travelers can now earn miles faster with the United℠ Business Card.

New United℠ Business Card cardholders can earn 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening. Plus, enjoy a $0 introductory annual fee for the first year, then $99.

You won’t have to worry about foreign transaction fees and you can order additional employee cards, free of charge. This card also features Chase’s contactless payment technology.

Award flights start at 12,500 miles each way for economy seats. The bonus is worth several domestic round-trip flights.

Get 2x Miles on Purchases Related to Business

United℠ Business Card cardholders earn 2x miles per $1 spent on United® purchases, dining (including eligible delivery services), at gas stations, office supply stores, and on local transit and commuting. Earn 1x mile per $1 spent on all other purchases.

Get Two One-Time United Club Passes

Each year, you get two one-time United Club℠ passes. You get two passes at account opening and on your card anniversary. These are worth more than $100.

Inside the United Club, you can enjoy complimentary snacks and beverages. Plus, you can also take advantage of business-friendly amenities, including free wifi and private workspaces.

Enjoy These United Travel Benefits

The United℠ Business Card offers these air travel benefits:

- Priority boarding for you and all companions on the same reservation on United-operated flights

- Free first checked bag for you and one travel companion (save up to $160 per roundtrip – terms apply)

- 2 one-time United Club passes each year

- No blackout dates when booking award flights

Additionally, get a $100 United® travel credit after 7 United flight purchases of $100 or more each anniversary year.

As a MileagePlus Premier member, you can enjoy complimentary space-available upgrades on United-operated flights. There are no foreign transaction fees to worry about.

Plus, all United credit card members can access exclusive MileagePlus and Inside Access events. Additionally, you can also enjoy elite hotel stays at the Luxury Hotel and Resort Collection.

Additionally, cardholders can receive a 5,000-mile “better together” bonus each anniversary when they have both the United℠ Business Card and a personal Chase United® credit card.

Redeeming Your United Miles

Your best redemption option will be United’s Saver Awards. These are the lowest price options for economy and premium cabin award flights.

If Saver Awards aren’t available for your travel dates, you can redeem your miles for an Everyday Award. These award flights require more miles. However, you can avoid blackout dates that non-MileagePlus cardholders may experience.

With any long-haul award flight, you won’t pay fuel surcharges that international carriers charge.

Although you might fly economy to stretch your miles further, you might find a better value in booking business class or the premium Polaris Business award seats. Owning the United℠ Business Card makes it easier to accumulate miles to book premium flights more often.

The United Business Card

The United℠ Business Card allows you to earn miles for business purchases, comes with flight perks for United-operated flights, and has zero foreign transaction fees. You can also get employee cards at no additional cost. Since United is one of the major airlines, you can count on having travel destination options.

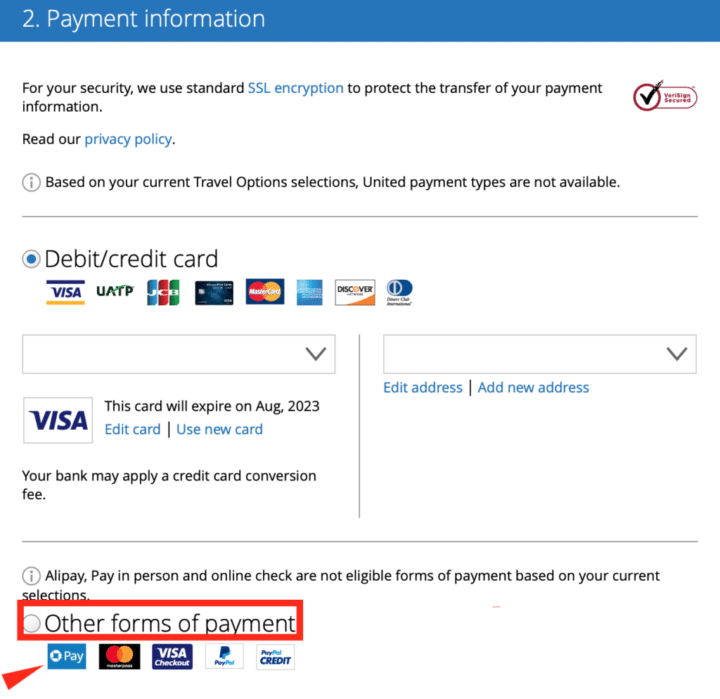

Use Chase Pay When Booking Your Next United Airlines Flight

Here’s another merchant that now accepts Chase Pay — United Airlines. A new partnership has made it easier to use your Chase United card to book your airfare and check out online.

How do you use Chase Pay to check out?

You book your airfare as usual, but you’ll see the Chase Pay symbol in the options to pay.

Using Chase Pay means you can still earn United miles or Chase rewards with your purchase. “With Chase Pay, our cardholders’ transactions will be more efficient while retaining all the benefits of their United branded credit card,” said Luc Bondar, president of MileagePlus Holdings and vice president of loyalty at United Airlines.

United has also said they will be adding Chase Pay to the United app in the upcoming months.

Which Chase credit cards can you use?

You can use any credit card that is tied to your Chase Pay — once you download the app, Chase automatically connects your cards for you.

Also check out: What is the Best United Airlines Credit Card?

What exactly is Chase Pay?

Chase Pay is a digital platform for Chase customers that allows them to pay online and through the app. The Chase Pay app can be used at various in-store locations. This includes airport restaurants and shops, gas stations, retailers, and grocery stores. Here’s a complete list of merchants that accept Chase Pay.

Chase customers can use their debit or credit card to pay quickly and securely. Popular Chase credit cards include the Chase Sapphire application rules.

Reasons to use Chase Pay

Your credit card information will never be shared with the merchant because Chase Pay uses a “token” (algorithmically generated numbers) in lieu of your credit card. This means your data will never be passed to merchants when you shop online or with the app.

The app also allows you to order food at participating restaurants ahead of time. So, it’s ready for you to pick it up.

There are also various deals, called Chase Offers, which you can take advantage of by using the app. For example, you can get $10 off a restaurant order or extra points for using Chase Pay at a particular store.

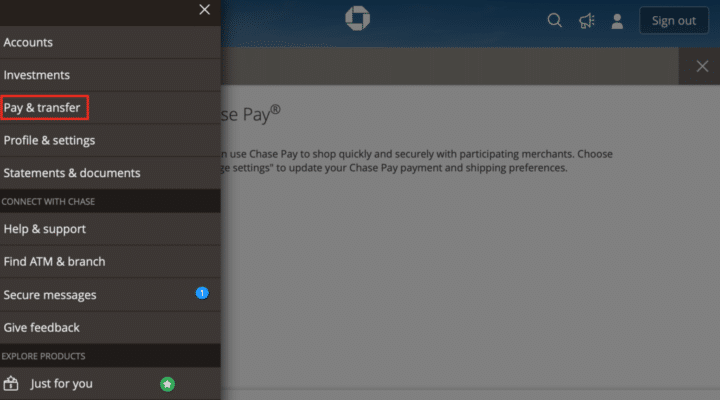

How to access Chase Pay

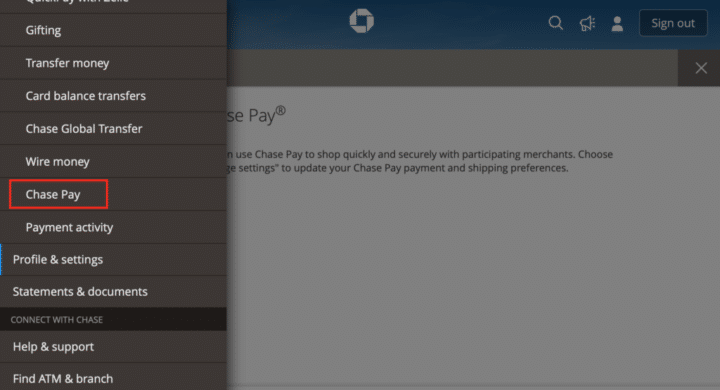

There are two ways to log in — one is through your computer. Log into your Chase account as usual and in the top left menu and click on “Pay and Transfer.”

Then click on the Chase Pay option.

Chase Pay app

Download the Chase Pay app to your phone and log in with your existing Chase credentials. After it’s downloaded, turn on your Chase location settings so you can see which merchants around you accept Chase Pay.

It also gives you the option to use your Ultimate Rewards points to pay for items. Keep in mind there are other ways to maximize your points. This includes booking travel or purchasing items through the Ultimate Rewards portal. Get more details about Chase Pay on Chase.com.

I just bought a ticket with United Airlines and got approved for a United Explorer credit Card. I also got cards for my wife and children. When my wife travels on Dec. 4, 2019 will she be able to check in a bag for free? Does she have to show her credit card? Please explain what we can do to be exempt from baggage charge. Thank you

Parviz Ighani

As long as the flight is bought with the United Airlines credit card you’re good to go!