This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Miles and points open a world of possibilities for new and experienced travelers. New travelers get the benefit of being able to travel the world for almost free, and more experienced travelers can subsidize their adventures and travel in premium cabins for little to no money.

If you’re new to miles and points, you’re in the right place. In this article, we’ll give you an overview of getting started with miles and points. We’ll discuss what kinds of points are out there and different ways of earning them. Let’s get started. Use the table below to jump to specific questions you might have:

- Options for Points and Miles

- How to Earn Points

- Considerations Before Picking a Points Program

- Breakdown of Rewards Programs

- Summary and Related Articles

What Are My Options for Points and Miles?

This beginner’s guide to points and miles should start by clarifying that there are a number of different types of points out there. The three types are airline miles, hotel points, and bank points. Here’s an overview of each type.

Airline Miles

Airline miles are tied to one airline loyalty program. Examples of these include Delta SkyMiles or United MileagePlus miles. You can use these points for flights on the parent airline’s flights or on its partners.

Hotel Points

Hotel points, like airline miles, are restricted to one hotel chain. Some good examples are Starwood Preferred Guest and World of Hyatt which has a new hotel credit card. You can use hotel points for hotel stays or, in some cases, transfer them to airline partners. However, it’s often not worth doing this.

A few notable exceptions are Starwood Preferred Guest as it gives you a 1:1 transfer ratio for most of its airline partners and Marriott’s Hotel + Air packages. As Starwood and Marriott continue to integrate their programs, it is still going to be worth it to transfer these points to airline miles, but the details will change somewhat.

Bank Points

These are our personal favorite points. Bank points include programs like Chase Ultimate Rewards, Citi ThankYou, and American Express Membership Rewards. These points can be used for anything from cash back to paid travel. Alternatively, they can be transferred to your airline miles of choice. For example, Chase Ultimate Rewards points can be transferred to United MileagePlus or redeemed for a trip to Europe.

We like bank points because of their flexibility. They let you keep your options open and redeem for sweet spots on different airline award charts.

How To Earn Points

Nowadays, you don’t have to fly to earn airline miles. Here are a few ways you can earn miles and points across all programs without stepping foot on an airplane.

Opening a Credit Card and Using It

One of the easiest ways to earn lots of miles and points is by opening a credit card. Most rewards cards have a sign-up bonus that awards a set number of miles after spending a specific amount of money on the card. For example, spend $3,000 in the first three months of card membership and receive 50,000 airline miles.

Keep spending on the card after you receive the signup bonus. This lets you earn miles on all of your everyday purchases. Plus, it keeps a steady flow of points to your award accounts on a monthly basis. Just make sure to pay off your credit cards on time and in-full to avoid fees and financing charges.

All major airlines and hotel chains have their own co-branded credit cards. Further, most banks offer their own lines of cards that award bank points. Research what card is best for you and sign up for one when you have a large purchase that covers the minimum spend.

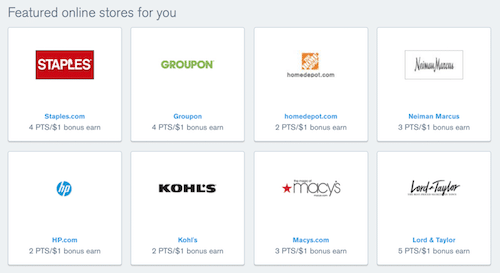

Shopping Portals

Shopping portals are a great way to earn extra points on your everyday purchases. Use CashbackMonitor to find a list of cash back portals that support your stores of choice. Then, when you need to make a purchase, click through the shopping portal and earn extra points.

Generally, stores offer between 1-10 points per $1 spent on their sites. Shopping portals do not make your shopping experience any different or make them cost any more. Use a shopping portal for all of your purchases, and you’ll rack up huge amounts of points in no time.

Tip: Need to make an in-store purchase? See if you can make it online and request an in-store pickup. This lets you use the shopping portal while still getting same day pick up at your local retail store.

Considerations Before Picking A Points Program

This beginner’s guide to points and miles wouldn’t be complete without mentioning strategy. Before choosing a points program to focus on, assess your travel goals and how you intend on using your miles. Want to fly Emirates in first class? You’ll want to focus on JAL and Alaska Airlines miles. Alternatively, if you want to fly short domestic flights for free, focus on British Airways. British Airways is a transfer partner of Chase Ultimate Rewards Points and Amex Travel Membership Rewards.

Another thing to consider is your time. Not all airline miles are easy to redeem. If you want to be able to hop on any flight for free, consider Southwest Rapid Rewards (Chase Ultimate Rewards partner) or JetBlue TrueBlue points. These points let you book tickets on any flight. Award prices are tagged to the price of the actual airline ticket.

On the other hand, more traditional miles like United (Chase Ultimate Rewards transfer partner) and American let members redeem based on the location of their destination, but often only release a handful of seats on each flight to people using points. This can be a pain but gives you great value when flying in first or business class.

Also, make sure that the airline where you’re earning your points services your home airport. There’s nothing worse than accumulating a bunch of miles you can’t use.

Breakdown of Rewards Programs

Study each program and find which best fits your needs. To aid you in your search, here’s what each airline reward program does best.

Alaska Mileage Plan: a variety of partners, so lots of award availability around the world

United MileagePlus: good award availability, easy to book awards

British Airways Avios: best for short-haul awards around the world

Starwood Preferred Guest: most flexible hotel points with tons of transfer partners

Chase Ultimate Rewards: most valuable transfer partners

American Express Membership Rewards: most transfer partners

JetBlue TrueBlue: any flight at any time, cost of awards fluctuate with the cash cost of the flight

Don’t Forget To Consider Credit Card Perks

If you’re a frequent traveler that’s just getting started with miles and points, consider getting a credit card with benefits. For example, many premium cards have complimentary lounge access, priority boarding, and free checked bags. A little research can help you find the best credit card for airline miles that fits your needs. Also, don’t forget you can earn even more rewards if you have a business and can apply for a business card.

Summary and Related Articles

As you can see, points and miles are relatively easy to earn, and a ton of fun to redeem. You can use them to see the world. Plan and figure out which card will earn you the most. In the comments, let us know your preferred way of earning miles and points.

Related Posts:

Best Travel Credit Card for Beginners

How Does Applying for Credit Cards Impact Your Credit Score

Getting Started with Travel Rewards

What is best site to sell my mileage?