This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Another increase on a hotel rewards card! I like it when the banks & loyalty programs compete. You can now earn 80,000 points after spending $1,000 on purchases within the first three months of account opening with the IHG® Rewards Club Select Credit Card. That’s a nice low minimum spend for the 80k IHG Rewards Club offer which is the highest public offer made available.

Editor’s Note: Some of the offers below may have expired or are no longer available on our site.

The IHG Rewards Club card is the one card I regret canceling because it comes with a free anniversary certificate which makes spending $49 to keep the card open a no-brainer. You can use your annual free night certificate at over 5,200 locations! I also love that the IHG Rewards Club card comes with a 10% rebate on all points redemptions and Platinum IHG status. Niiice.

Plus, you can earn an additional 5,000 points if you add an authorized user and make a purchase in the same time period. The $49 annual fee is waived for the first year.

Some people may prefer the 80,000 point offer on the Marriott Premier card, but it appears that the IHG Rewards Club doesn’t fall under Chase’s 5/24 rule which is a big deal.

Redeeming IHG Points

The IHG hotel chain consists of hotels ranging from high-end, business travel, family travel, or just plain budget. The properties include:

- Candlewood Suites

- Crowne Plaza

- Holiday Inn Hotels & Resorts

- Holiday Inn Club Vacations

- Holiday Inn Express

- Hotel Indigo

- InterContinental

- Staybridge Suites

- Hualuxe

- Even Hotels

- Kimpton

As you can see, there’s a hotel brand for every kind of traveler.

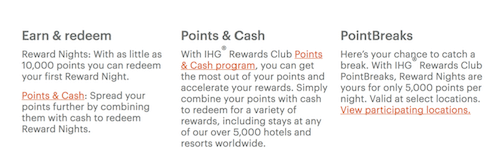

The best value for your IHG redemptions is if you can redeem your IHG points for 5,000 points a night Point Breaks deals. Availability can be hard to find, but if you do, you’re doing great!

You can also combine your IHG Points + Cash for hotel redemptions.

It’s also worth mentioning that the IHG Rewards Club program is a transfer partner of Chase’s Ultimate Rewards. So you can top off your IHG account if you hold an Ink card or Chase Sapphire Preferred® Card.

Summary on the New 80k IHG Rewards Club Offer

Even for occasional travelers the IHG® Rewards Club Select Credit Card really could be classified as a “must have.” It comes with a great sign-up bonus of 80,000 points and boasts one of the lowest annual fees offered on a rewards card. The annual fee is $49, but it’s waived for the first year of membership. Plus, you get a free anniversary night certificate good for any category IHG!

The IHG Rewards Club card also comes with Platinum status, 10% rebate on all reward redemptions, no foreign transaction fees, and you earn 2x points per $1 on gas, groceries, and restaurants. I love the Platinum status, and 10% rebate perks, but prefer to put my normal spending on this rewards card.