This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Over 51 million people travel on U.S. airlines during the holiday season. As travelers, we do all we can to prepare for travel, but sometimes, getting through a massive line at TSA can be painful. Fortunately, there are ways around it like getting TSA PreCheck or flying JSX which doesn’t require passengers to go through TSA screenings. Even better, now you can fly JSX through Chase’s Travel portal.

Plus, if you don’t have a Chase credit card yet, this is one more reason to get one. This is especially true if you want to know what it feels like to travel on a private jet!

What is JSX?

For those who aren’t familiar, JSX is a private charter plane that doesn’t require passengers to go through TSA screening. Forget removing your shoes, laptops, toiletries, and dumping out your water bottles. All you need to do is show up a half-hour before your flight and relax in the hanger.

The Burbank JSX hanger offered comfy couches, coffee, tea, snacks (chips, crackers) and WiFi.

Essentially, JSX combines commercial air travel and private jets as each flight only carries 30 people. They mostly operate on the West Coast (California, Nevada, and Arizona), but they’re growing fast. JSX prides itself on being a “hop-on jet service.”

At the time of writing, JSX operates out of:

- Burbank (BUR)

- Las Vegas (LAS)

- Orange County (SNA)

- Napa/Concord (CCR)

- Oakland (OAK)

- Seattle-Boeing Field (BFI)

- Phoenix (PHX)I

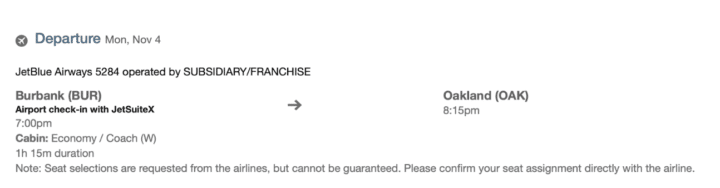

I recently flew on JSX for the first time and booked it with my Chase Sapphire Reserve®.

Since Jetblue has a partnership with JSX, the flight popped up when I searched for a last-minute flight from Burbank to Oakland. Basically, I waited in the hanger, which is separate from the rest of Burbank Airport. I walked in, showed my driver’s license to a JSX employee who checked me in. She took my carry-on bag and tagged it (the plane is so small you can’t fit carry-on bags in the overhead bins).

Then, I sat on a couch in the hanger, directly in front of the plane, and waited to board. After an hour and 15 minutes, I was in Oakland.

Once we landed, we waited for about 15 minutes for the JSX baggage team to hand us our bags.

Redeeming Points to Pay for JSX Flights

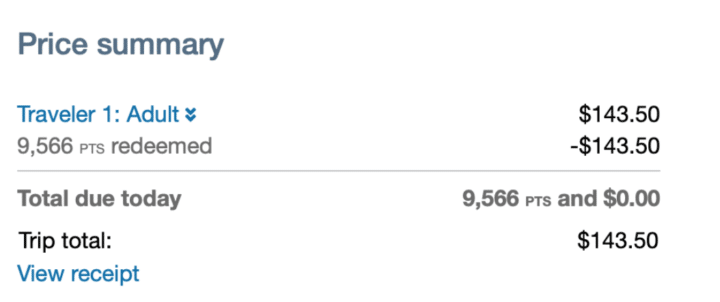

JSX may be a bit more expensive than low-fare air travel. I booked my ticket last-minute, which is why the one-way flight was $143.50. I redeemed my points (9,566 points) to pay for it.

Chase Travel Benefits & Perks

Being able to book flights on JSX through Chase Travel is just one more reason I wouldn’t use any other card to search for flights when I travel. The Chase Sapphire Reserve perks are also numerous.

In addition, there are other ways to earn extra points through buying gift cards or shopping through Chase Travel. This includes using points to pay for purchases on Amazon or Apple products.

Chase also has a robust travel partner program. This means you can easily transfer points on a 1:1 basis if you want more options for travel or want to fly on a different airline.