This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

We’ve all been there: You’re stoked about an upcoming trip. Perhaps you’ve finally got just enough points/miles saved thanks to your use of the best credit card for miles. This will be enough to cover the flight that you can’t wait to book. You jump at the opportunity to catch a fare sale to a faraway land, giddy that the only cost was a few bucks in taxes and fees.

But, maybe you’re also a little disheartened at your depleted rewards account. “Oh well,” you think. “I’m going somewhere awesome!” There’s nothing worse than finding out later that you could have saved a quarter of those hard-earned miles if you would have just transferred those Chase Ultimate Rewards points to an airline program instead of booking directly through a credit card booking portal like Chase Travel℠.

Lessons Learned

It’s happened to the best of us, including me, a fairly experienced traveler. Unfortunately, when I booked a one-way ticket to Australia, I hadn’t yet become acquainted with the best ways to get the most out of my Chase Ultimate Rewards points.

I assumed the best way to (always) get the most bang for my buck was by booking online through Ultimate Rewards where I would get 25% of my points back after booking. That mindset ended up costing me in the end.

I’ll tell you how to avoid making the same mistake. But before we get into it, let’s talk about how to earn those coveted Chase Ultimate Rewards. Cards like the Chase Sapphire Preferred® Card come with a multitude of travel benefits and earn valuable points.

How To Earn With The Chase Sapphire Preferred

The truth is, the Chase Sapphire Preferred card is a great choice for travelers. There are also all of the Chase Sapphire Preferred perks. Plus, points are worth 25% more when you book travel online through the Chase Travel℠ website. There, each point is worth 1.25 cents.

This is a great deal for cheap domestic flights, car rentals, cruises, even hotels, and activities. But occasionally, if you’d prefer to book business or first-class seats or expensive international flights, transferring points to frequent traveler partners will save you a lot of miles in the end.

Transferring Chase Ultimate Rewards Points

First, you must accrue enough points to redeem an award ticket. How many points you’ll need will depend largely on your preferred carrier, how much the flight costs, and what the airline’s procedure is for calculating the cost in miles. In my case, I needed to book two one-way tickets from Los Angeles to Sydney, Australia that cost $800 each on Air New Zealand or 63,500 points if booked through Chase Travel℠.

Once I earned those points, they took me a good chunk of the way. In three months I had earned 63,000 points (after earning the signup bonus): 50,000 as the sign-up bonus, 5,000 for adding a registered user to my account (my husband), and 8,000 from the $4,000 I spent in the first three months.

From there, I continued to use my Chase Sapphire Preferred® Card for everything from groceries to gas, making sure to sign up with shopping and dining programs through my favorite airline to earn additional frequent flyer miles for participating in everyday activities.

At the end of approximately a year and a half, I had 165,000 points, plenty for two reward tickets booked through Chase Travel℠.

How to Maximize Points with Chase Sapphire Preferred

However, things would have been much different if I would have transferred my UR points to my United MileagePlus frequent flyer account. Other airlines, like British Airways, also offer flights to Australia through their own fleet or partner airlines. But they cost a minimum of 50,000 miles and come with taxes and surcharges in the triple digits.

For example, a one-way flight from LAX to SYD on United and its partners only costs 40,000 miles. That’s quite a bit less than the amount I would need on Chase Travel℠! Even after factoring in the 25% point bonus if I booked through Chase Travel℠, I still would have saved 23,500 of my miles for a future trip.

That’s almost enough for a domestic round-trip ticket on many airlines, including United.

All that would have been required to save some 40,000 total miles would be to transfer my points to my preferred airline program and book online through the airline website.

Transfer Partners

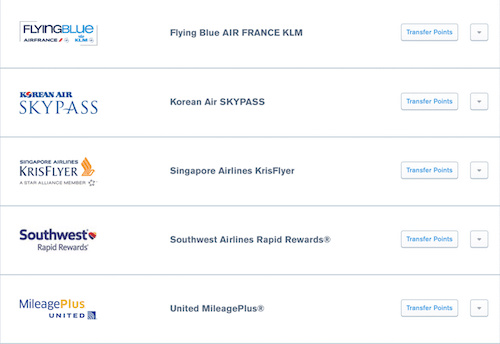

Partner airlines include:

- Aer Lingus AerClub

- Emirates

- Aeroplan

- British Airways Executive Club

- Air France/KLM Flying Blue

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- Iberia Plus

- Hyatt Gold Passport

- IHG Rewards Club

- Marriott Bonvoy

Points are transferred on a 1:1 ratio across the board. That means every credit card point is worth one mile with a participating airline. Each program gives a different value to their miles, but often they are worth between 1.5-2 cents per mile. United’s are worth 1.5 cents.

That’s a bit more than Chase’s 1.25 cents per point.

The variety of partners is good, so you should still be able to get wherever you want to go, be it Australia, Paris, or Tokyo.

How To Transfer Chase Points

Transferring miles to your preferred partner airline is easy. You first have to log into your Chase account and select “Chase Travel℠” on the left side of the page.

There will be a page of redemption options including travel, gift cards, cash back, transfer to travel partners and Amazon.com shop with points.

You’ll select “Transfer your points” under Transfer to Travel Partners. From there, you’ll be taken to a list of partnering airline rewards programs.

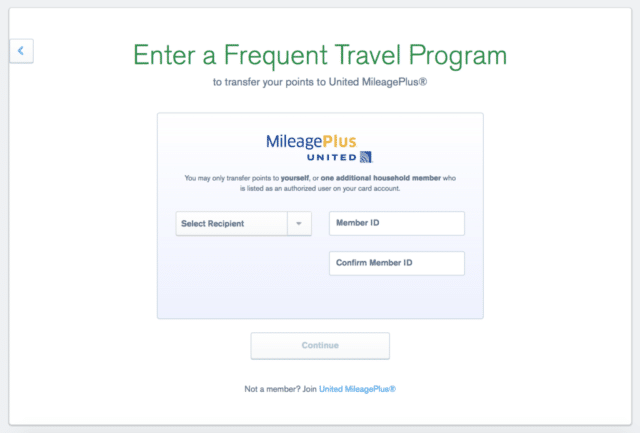

Select the airline you wish to transfer miles to. In this case, my best bet would have been United.

Then type in your account details and the amount you want to transfer in increments of 1,000. You’ll be asked to confirm the transfer amount (transfers are non-refundable so make sure it’s the transfer you want) and that’s that. The miles should show up in your account almost immediately though there may be some delays as is the case when transferring Capital One miles and transferring American Express points.

From there you will log into your frequent flier account and book whatever flight you want using your reward miles, saving a ton in the process. It works the same for destinations around the globe, though the airline partner you’d want to transfer your points to might be different. And obviously, you’d save twice as much with round-trip tickets.

When Transferring Chase Points Isn’t The Best Option…

Transferring points is not always the best option, though. Make sure before you transfer or book that you are indeed getting the best deal. Cheaper domestic flights might only cost $150 if you were paying in cash or 12,000 points if booked through Chase Ultimate Rewards. That same flight could be around 25,000 miles on many U.S. airlines.

Do your homework to ensure you’re not throwing your miles away as I did. You’ll be one happy traveler indeed. You live, and you learn.