This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page. The information for all Chase cards has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

If you’re shopping for a credit card, you’ve likely noticed that there are many options available. Not only do various banks offer a range of choices, but each bank seems to have more credit cards than Baskin Robbins has ice cream flavors. Fortunately, there’s a tool called CardMatch™ that helps narrow down the available options and predicts which cards you have the best chance of getting approved for.

Even if you’re not in the market for a new card, this tool is useful for exploring what options exist. It can help you decide if now is a good time to apply for a card, especially since the CardMatch tool sometimes offers enhanced targeted bonuses.

Learn More: CardMatch™

Hard Inquiry vs. Soft Inquiry

A credit inquiry happens when a bank or lender looks at your credit score to determine whether or not they should approve your application. There are two types of credit inquiries in the credit world: hard and soft.

Hard Inquiry

A hard inquiry happens when you apply for new credit (such as a loan or credit card) or a credit increase. That inquiry appears on your credit report. Hard inquiries generally will reduce your credit score by 3 to 5 points. They will stay on your credit report for up to 2 years. Although hard inquiries will stay on your credit report, their impact on your credit score is concentrated during the first six months after the inquiry.

Soft Inquiry

A soft credit inquiry occurs when a company takes a look at your credit but doesn’t perform a hard inquiry. Soft inquiries happen all of the time, most without your knowledge. This is because the banks you have a relationship with want to make sure that you are maintaining your credit responsibly.

Banks know that you could have trouble elsewhere even if you’re performing fine with them. They don’t want to be the last one to find out you just lost your job, are getting divorced, or have any other reason why you may be having financial issues. It would leave them with a debt they cannot collect.

When you speak with your bank and request a credit limit increase, some banks will perform a soft inquiry as a courtesy to review your request. Before asking for the increase, confirm with the company representative whether it will be a hard inquiry or a soft inquiry. If they don’t know or seem unsure of the answer, ask them to verify with their supervisor.

Is CardMatch the first place you should look?

What makes the CardMatch™ tool the first place you should look before applying for a credit card is that it is a soft inquiry. This means that your credit score won’t be affected when you use the CardMatch Tool.

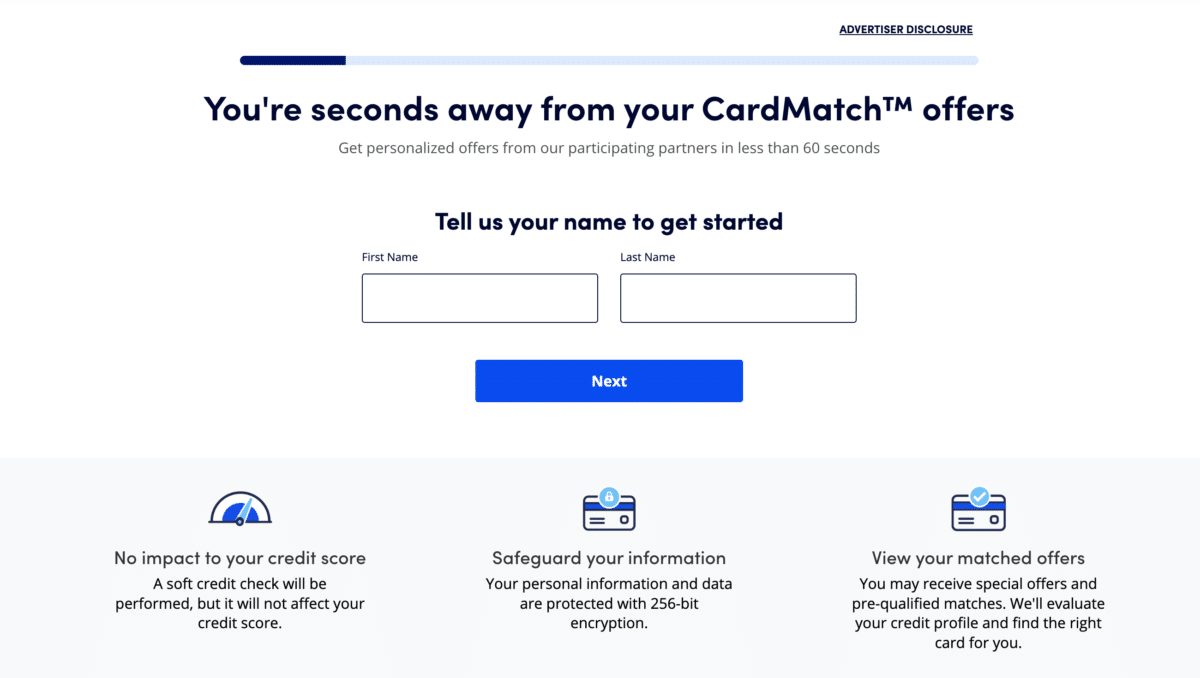

To start, go to the CardMatch™ Tool.

Enter basic information like your name, address, and last four digits of your Social Security number. Within a few seconds, a list of the best credit card options that you are most likely to get approved will be presented to you.

Don’t worry if you don’t like any of those options. You are under no obligation to apply. Plus, there was no effect on your credit score for taking a peek.

You can look often because your credit score isn’t affected by looking at the CardMatch™ tool. But I wouldn’t recommend checking every day, as nothing will change that quickly.

If you’re searching for a card and know your score is adequate for the credit card you want, log in to CardMatch every few weeks until you find the right offer.

Does the CardMatch Tool share all of my options?

The CardMatch™ tool is great in its simplicity. It focuses on the best credit cards that you are most likely to get approved for. But, it does not share all of the credit cards that you qualify for.

When I checked the offers that were available to me, only three credit cards came back:

Surely, there are more than three credit cards that I can get approved for! Many banks besides Chase would love to have my business. However, the CardMatch Tool is designed to filter out the best credit cards available to you for which you have the best chances of approval.

If you have good (or great) credit, there are easily 30+ credit cards you could get approved for. The average person would be overwhelmed with that many options.

Should I apply for a credit card with CardMatch?

If you find an offer that interests you, consider it. However, before you do, keep these questions in mind.

- Will you be applying for a mortgage, business, or auto loan in the next six months? Travel credit card rewards are great, but they aren’t worth losing out on a loan you really need. Or, you may have to accept less than the best interest rates and terms because of recent inquiries.

- Where will you use the points and miles? Travel rewards have a habit of devaluing over time. You don’t want to earn a bunch of rewards, like valuable travel miles, that you won’t be using for years. There’s a reason why “earn and burn” is the motto of experienced travel hackers.

- Are you OK with the annual fee? A majority of travel credit cards have an annual fee, although some are waived in the first year. Aside from the welcome bonus, do the benefits you receive outweigh the annual fee? FYI, there are also some no-annual-fee travel credit cards that are worth considering.

- Can you meet the minimum spend? It would be great to earn all of those bonus points when you sign up for a new credit card. But if you cannot meet the minimum spend in the time required (usually three months, though some credit card companies are giving new cardholders six months to earn their bonus), all of that effort was for nothing. A lot of people time their applications 1 to 2 months ahead of major bills. By doing that, they can more easily meet the minimum spend.

What happens next?

If the card you covet isn’t listed by CardMatch™, take steps to increase your credit score before trying again. A quick way to increase your credit score is to pay down your balances. You can also consolidate your credit card debt into a loan. Additionally, you can increase your credit limit to reduce utilization.

Once you find the card you want with the CardMatch tool, you can apply.

Looking at Card Match for Bigger Bonuses!

When applying for credit cards, you don’t want to risk lowering your credit score with a declined credit inquiry. By narrowing your options to those with the highest approval chances, you can devote your time (and precious credit score) to applying for cards that are more likely to be approved. Once you know which credit cards offer you the best chances, you can search for the offers and apply for them to maximize your rewards.

Learn more: CardMatch™

Related Articles: