Soon after my buddy Jim Grace began selling travel insurance, he realized there was a need in the market for a better way for consumers to purchase what they were seeking. So in 2000, he founded the world’s first travel insurance aggregation site, InsureMyTrip.com. Today, it’s the Kayak of travel insurance, featuring all the major travel insurance providers and then some.

Soon after my buddy Jim Grace began selling travel insurance, he realized there was a need in the market for a better way for consumers to purchase what they were seeking. So in 2000, he founded the world’s first travel insurance aggregation site, InsureMyTrip.com. Today, it’s the Kayak of travel insurance, featuring all the major travel insurance providers and then some.

The website works with 27 different providers to help you find the right plan for your needs. On top of that, they have a state-of-the-art Customer Care Center that operates 365 days a year.

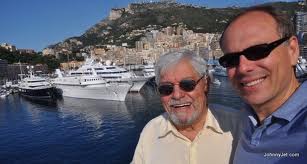

I first started using it just prior to taking my then-82-year-old dad to Europe. I had been told by numerous people that because of his age, I wouldn’t be able to find travel insurance for him and if somehow I did, it would cost me an arm and a leg.

Upon checking out InsureMyTrip.com, I was quickly told I had two providers who would insure my dad’s trip—and because we were going on free tickets, the option we chose was super cheap (I can’t even remember the exact amount but it was under $150, and possibly just $75). In any case, it was an incredible bargain for the peace of mind we were getting, especially since he was starting to act old. But in the end, fully-covered, the trip brought the kid out in him and he’s been significantly younger since, after spending time with his long-lost aunts.

Good to know:

- InsureMyTrip.com offers 24/7 protection.

- They provide more options than any other travel insurance website.

- All of the companies on the website are rated by A.M. Best, an independent organization that rates insurance companies according to their financial strength; you can see each insurance company’s A.M. Best rating while comparing or viewing policies on the website.

- Insurance policies cannot be purchased if you have already departed on your trip.

- Most of the packages they offer provide coverage for Trip Cancellation and Trip Interruption due to a non-traveling family member’s unforeseen death or illness requiring you to stay home or return home earlier than expected. Each policy defines “family member” differently, but most include parents, grandparents, children, grandchildren, siblings, aunts, uncles, spouses and domestic partners under their definition.

- There are some plans that do cover the optional Cancel For Any Reason coverage.

- Some policies will cover cancellation due to a hurricane if your trip destination is under a hurricane warning issued by the NOAA National Hurricane Center.

- Most plans offer Trip Cancellation and Trip Interruption coverage for a “Terrorist Incident” that occurs in a city on the itinerary during the course of travel. Each company defines “Terrorist Incident” differently. There are no policies that offer coverage for the threat of a “Terrorist Incident” or for any war-related activity.

- Medicare does not provide coverage while outside of the U.S. which is why I wanted travel insurance for my dad for our Italy trip.

- In 2011, they launched the first Customer Ratings and Reviews forum in the travel insurance industry.

- More InsureMyTrip.com FAQs

Editor’s note: I tried out InsureMyTrip.com in preparation for my trip to deep Uganda, and it couldn’t have been easier. I called them up, spoke with a friendly guy for about 15 minutes and that was that. Outrageously easy and silly cheap.

I used their online service earlier this year for a month volunteering in South Africa. They had a great selection of services and i was able to find just the right policy. Great customer service.

The site is laid out well. My issue is with the insurers, there are too many restrictions on purchasing the insurance within a couple of weeks of booking your travel. My cruise isn’t for another year and a half, they do not appear to truly cater to those travelers that actually plan their travel out ahead, way ahead.