This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page. The information for all Chase cards has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

People often ask me, “What’s the best Chase credit card I should get if I want to travel more?” I almost always recommend the Chase Sapphire Preferred® Card. Cardholders can transfer their points on a 1:1 basis to top travel partners, including United, Southwest, and World of Hyatt. Additionally, cardholders can get 25% more value when they book travel through the Chase travel portal. The Chase Sapphire Preferred also comes with benefits for lifestyle purchases like streaming services and dining.

However, for some folks, the Southwest Rapid Rewards credit cards can be great if they live near an airport that Southwest frequents for domestic (and a few international) destinations. Southwest remains a favorite for many travelers thanks to low fares, free checked bags, and open seating. Southwest also continues to add destinations, giving folks more options to explore. Additionally, earning the Southwest Companion Pass® is essentially a buy one, get one (nearly) free on flights!

You may even try for both cards!

However, it’s a tricky situation since Chase will most likely decline you for either credit card if you’ve applied for 5+ cards in the last 24 months, so you’ll want to choose wisely. Luckily, we are going to break down the pros and cons of these cards to help you make the best decision.

Chase Sapphire Preferred vs Southwest Credit Card

If you are trying to determine which card is better between the Sapphire Preferred or Southwest Credit Cards, this review can help you narrow down your options.

Before we jump into this review of these consumer cards, here’s a sneak preview of some of the top benefits of the Chase Sapphire Preferred and Southwest Credit Cards:

- 75,000 Bonus Points Offer: Chase Sapphire Preferred® Card

- 7,500 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Priority Credit Card

- 6,000 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Premier Credit Card

- 3,000 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Plus Credit Card

So if you’re wondering if the Chase Sapphire Preferred or Southwest Credit Card makes the most sense for you, here’s my advice…

Get the Chase Sapphire Preferred if…

1. You like to travel internationally.

I love to travel abroad. That’s where the real value is when we’re talking miles and points, especially when you’re redeeming points for international premium cabin flights. These flights can get up to the $10,000 mark! I don’t think I will ever be in a financial situation where I could pay that kind of coin for a plane ticket.

I’ve used points earned from my Chase Sapphire Preferred® Card towards premium cabin flights on Lufthansa (many times), Thai Air, and Singapore Airlines. It’s a little sexier than using my Southwest Rapid Rewards to fly to, say, San Diego. Even though I love San Diego, Las Vegas, and many other domestic destinations, buying those plane tickets with $$ is more feasible than paying the big bucks for international travel.

Plus, the Chase Sapphire Preferred signup bonus can set you up to travel.

New Chase Sapphire Preferred® Card cardholders can earn 75,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

It also has no foreign transaction fee, which makes it great for international travel. Note that the Southwest Premier and Priority cards don’t have a foreign transaction fee, but the Plus has a 3% fee.

It’s worth noting that you can fly to some Mexico/Caribbean locations with Southwest Rapid Rewards points.

2. You want a solid daily card.

The Chase Sapphire Preferred is hands-down a better daily card.

The Chase Sapphire Preferred earns unlimited:

- 5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Also 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

There is a $50 annual Hotel Credit. It comes in the form of a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Chase Travel℠ program, up to an annual maximum accumulation of $50.

Plus, on each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Plus, the annual fee is only $95.

3. You don’t like boarding like a herd of cattle.

I have a love/hate relationship with Southwest. I usually enjoy the customer service, but I dread the boarding process even when I’m not in the A group. I’m usually traveling with a companion, so there’s always that awkward moment when I’m holding a seat, trying not to make eye contact with the people passing by. It’s a cluster.

What’s worse is when the departing plane already has passengers on it, and they’ve taken all the good seats. How dare they! I’ve even paid for the privilege of boarding first (Early Bird), only to find the cabin already full of people when I boarded.

4. You want respect.

This isn’t really an important point, but I remember the first time I pulled my Sapphire Preferred out of the envelope. I almost dropped it. This is a legit card that’s heavy and made out of real metal. Every time a friend or family member gets the Chase Sapphire Preferred, they always call me afterward pumped about how cool it looks and how every time they pay with it, the cashier is blown away by its sleek design.

Adding to the aesthetic delight, Chase put the numbers on the back of the card. Brilliant. Anyway, it’s just a cooler card than the Southwest cards, for what that’s worth.

5. You like the flexibility.

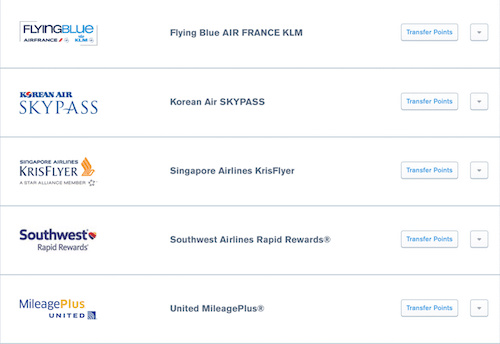

Points transfer into Southwest as well as many other top travel programs such as Hyatt, Marriott, IHG, United, British Airways, and Air France. Yeah, great options.

6. You shop online or want to maximize your rewards.

The Sapphire Preferred gives you access to the point-maximizing shopping portal. Don’t buy anything online without seeing if you can earn an extra point bonus by shopping through the UR portal. It’s a great way to double-dip if your card gets a category bonus already. For example, Nike and even Apple will randomly have a 10x bonus.

7. You will use the additional Chase Sapphire Preferred benefits.

And just in case you want to learn more about the Chase Sapphire Preferred and its premium sister card, the Chase Sapphire Reserve®, you can review our Chase Sapphire Preferred vs Chase Sapphire Reserve review.

Let’s move along in this Chase Sapphire Preferred vs Southwest Credit Card comparison.

Get the Southwest Airlines Credit Card if…

So, I made a really strong case for the Chase Sapphire Preferred Card there, but here are a couple of reasons why you would choose a Southwest card over the Sapphire Preferred. They are:

1. You can make special use of the multiple versions.

There are more options to choose from with the Southwest-branded cards. There are the personal Southwest credit cards and business Southwest credit cards, so you have options.

New Southwest Airlines (consumer) credit cardholders can earn 50,000 points after spending $1,000 on purchases in the first 3 months from account opening.

The three consumer Southwest Rapid Rewards credit cards that come with the enhanced bonus are:

- Southwest Rapid Rewards® Priority Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- The Southwest Rapid Rewards® Plus Credit Card

Southwest Rapid Rewards Plus Credit Card

The Southwest Rapid Rewards® Plus Credit Card comes with the ability to earn 2x points for every $1

you spend on Southwest Airlines® purchases and on Rapid Rewards hotel and car partners. You’ll also earn 2x points per $1 spent on local transit and commuting, including rideshares, and 2x points per $1

spent on internet, cable, phone services, and select streaming services.

Cardholders can enjoy 2 EarlyBird check-ins per year, 25% back on inflight purchases, and 3,000 points every year on their cardholder anniversary.

This is a great card if you don’t fly Southwest too often but still fly often enough to take advantage of the perks. The annual fee is $69. Foreign transaction fees do apply.

Southwest Rapid Rewards Premier Credit Card

If you want a few more perks, including 6,000 bonus points every cardmember anniversary, 3x points for every $1 spent on Southwest Airlines purchases, and no foreign transaction fees, consider the Southwest Rapid Rewards® Premier Credit Card.

This card earns 2x points for every $1 spent on:

- Rapid Rewards hotel and car partners

- Local transit and commuting, including rideshare

- Internet, cable, phone services, and select streaming

Cardholders also earn 1,500 TQPs toward A-List status for every $10,000 spent, with no limit on the amount of TQPs they can earn. Two EarlyBird check-ins per year and 25% back on inflight purchases can also be enjoyed.

While there are no foreign transaction fees, there is a $99 annual fee.

Southwest Rapid Rewards Priority Credit Card

If the above two cards sound good, but you want something with more oomph and will be flying Southwest more often, consider the top consumer Southwest card—the Southwest Rapid Rewards® Priority Credit Card. Not only will you get 7,500 points every year on your cardmember anniversary, but you’ll also be able to enjoy 4 upgrading boardings per year and a $75 Southwest annual travel credit.

Cardholders earn 3x points for every $1 spent on Southwest Airlines purchases. They also earn 2x points for every $1 spent on Rapid Rewards hotel and car partners, local transit, local commuting (including rideshares), and on internet, cable, phone services, and select streaming.

Additionally, they can enjoy 25% back on in-flight purchases. Cardholders also earn 1,500 TQPs toward A-List status for every $10,000 spent, with no limit on the amount of TQPs they can earn.

There are no foreign transaction fees on this card, but the annual fee is $149. However, if you use the $75 annual Southwest travel credit, you can offset your annual fee, making it only $74, which is only $5 more than the Plus annual fee.

All three consumer cards earn 1x points per $1 spent on all other purchases.

Southwest Rapid Rewards Premier Business Credit Card

If a Southwest business card is more of what you need for your fare deal for the fall, there are two cards to consider. The Southwest® Rapid Rewards® Premier Business Credit Card comes with 6,000 points every year on your cardmember anniversary, 25% back on Inflight purchases, 2 EarlyBird Check-In® per year, the ability to earn 1,500 tier qualifying points toward A-List status for every $10,000 spent, and a $500 fee credit for points transfers per year.

Cardholders earn 3x points for every $1 spent on Southwest Airlines® purchases. They also earn 2x points for every $1 spent on Rapid Rewards hotel and car rental partner purchases, on local transit and commuting, including rideshare, and 1x point per $1 spent on all other purchases.

New Southwest® Rapid Rewards® Premier Business Credit Card cardholders can earn 60,000 points after spending $3,000 on purchases in the first 3 months from account opening.

Employee cards come at no additional cost while you can also earn points on employee spending. There are no foreign transaction fees, but the annual fee is $99.

Southwest Rapid Rewards Performance Business Credit Card

The other business card option is the Southwest® Rapid Rewards® Performance Business Credit Card. It comes with 9,000 points every year on your cardmember anniversary, four upgraded boardings per year when available, up to $120 Global Entry or TSA PreCheck® fee credit every 4 years as reimbursement for the application fee for Global Entry, TSA PreCheck®, or NEXUS, and up to 365 inflight WiFi Credits

per year.

This card earns:

- 4x points for every $1 spent on Southwest Airlines® purchases

- 3x points for every $1 spent with Rapid Rewards hotel and car rental partners

- 2x points for every $1 spent on social media and search engine advertising, internet, cable, and phone services

- 2x points per $1 spent on local transit and commuting, including rideshares

- 1 point for every $1 spent on all other purchases

Cardholders can also take advantage of the $500 fee credit for points transfers per year, free employee cards that also earn points on employee spending, and the ability to earn 1,500 tier qualifying points toward A-List status for every $10,000 spent.

New Southwest® Rapid Rewards® Performance Business Credit Card card members can earn 80,000 points after spending $5,000 on purchases in the first 3 months from account opening.

There are no foreign transaction fees, but the annual fee is $199.

2. You want to travel only domestically (though there are a couple of international routes available).

If you want to only travel domestically and/or Southwest services your specific routes best, then it’s a no-brainer to go for the Southwest Rapid Rewards® Premier Credit Card.

It’s still a close call, though because I often use points to transfer to British Airways Avios for short-haul domestic flights.

3. You want the Southwest Companion Pass®.

This is the biggest perk of the Southwest loyalty program and is probably the best domestic travel deal…in the world. To receive the standard Southwest Companion Pass® you must earn 135,000 qualifying miles in a calendar year. The Companion Pass allows you to bring a guest with you on revenue and award flights. It’s nice.

To truly maximize the standard Companion Pass, you want to meet the qualifications as early in the year as possible. That’s because you receive the Companion Pass for the remainder of the year you met the 135,000 tier in, plus the full year following.

And just so you know the points earned from the Southwest Rapid Rewards® Priority Credit Card, Southwest Rapid Rewards® Plus Credit Card, and the Southwest Rapid Rewards® Premier Credit Card as well as the business cards, do count towards the Companion Pass.

Plus, you can redeem your points for flights, hotel stays, gift cards, access to events, and more.

Jumpstart Earnings With the Signup Bonus Offer

New Southwest Airlines (consumer) credit cardholders can earn 50,000 points after spending $1,000 on purchases in the first 3 months from account opening.

The three consumer Southwest Rapid Rewards credit cards that come with the enhanced bonus are:

- Southwest Rapid Rewards® Priority Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- The Southwest Rapid Rewards® Plus Credit Card

Note that points from other cards, including the Chase Sapphire Preferred, that are transferred into Southwest do not count towards the Southwest Companion Pass®.

Conclusion

So, between the Chase Sapphire Preferred and Southwest credit cards, which one works best? I have had both the Chase Sapphire Preferred (I still have) and Southwest cards and enjoyed the specific benefits of each one. But, I value international travel, and Sapphire Preferred works better for me. However, the Southwest Companion Pass® is a very good deal if you can reach the qualifications and will be flying from the Southwest hubs. If you’re looking for which credit card to try, look at what best suits your spending and your travel goals.

Chase Sapphire Preferred and Southwest Credit Card options:

- 75,000 Bonus Points Offer: Chase Sapphire Preferred® Card

- 7,500 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Priority Credit Card

- 6,000 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Premier Credit Card

- 3,000 Annual Anniversary Bonus Points: Southwest Rapid Rewards® Plus Credit Card

I don’t see a reason to keep the Southwest card if you only make two domestic flights per year, don’t purchase anything on a SW flight and expect to fly internationally. To me, the Chase Sapphire is the best way to go. No extra annual fee to pay by eliminating Southwest.

Can’t go wrong with the Chase Sapphire Preferred!

Does the southwest card offer a metal version?

I don’t believe the SW cards are metal.